Governor Ducey Signs Major Property Tax Reduction

PHOENIX, AZ – March 30, 2022

HB 2822

Signed into law March 30, 2022

What is HB 2822?

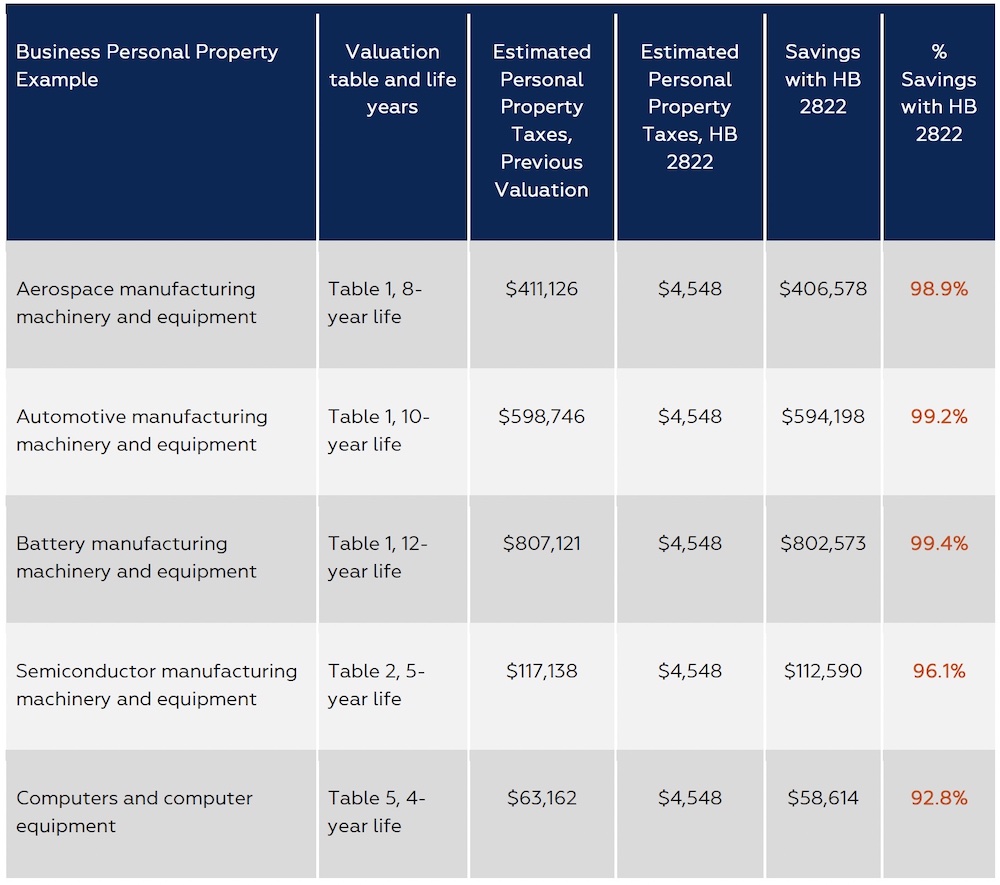

HB 2822 substantially lowers personal property tax liability for business owners by 90% or more by accelerating and simplifying the depreciation schedule for business personal property. The law also benefits small business owners by simplifying and streamlining business personal property liability.

Background

Under current law, most business personal property was valued at approximately 25% of its scheduled depreciated value in the first service year – a value that increased to as high as 89% of the scheduled depreciated value in the fifth tax year of assessment, depending on the asset being depreciated.

New reforms

HB 2822 sets the valuation factor for Class 1, Class 2(P), and Class 6 of new personal property to 2.5%. Under the new law, all qualifying property classified during or after 2022 is valued at 2.5%, regardless of equipment type or use, creating a low, uniform, and consistent taxable value.

Summaries of each applicable class are as follows:

- Class 1: Properties of shopping centers; golf courses; manufacturers; and most other commercial or industrial property.

- Class 2: Agricultural property and properties of nonprofit organizations.

- Class 6: Property located in a foreign trade or military reuse zone.

Examples of assets eligible under the new law include computers and technology, furniture fixtures and equipment, manufacturing equipment, machinery, warehouse materials handling equipment, restaurant ovens, refrigeration/food storage equipment, office supplies, tractors, sprinkler systems, hay balers, and cotton harvesters.

Timeline

The new law applies to business personal property classified during or after tax year 2022.

Table 1.0 on the following page demonstrates how the new law amounts to major savings of well over 90% for many business personal property investments.

Table 1.0. Personal property taxes on $10 million of capital expenditures, Class 1 property. 20-year estimates

For more information, click here to download the HB 2822 Fact Sheet.

(Photo by Arizona Commerce Authority)